Share Pledge Price :

$1,131

Selections Made Weekly

10% Deposit

Invest in Our Future

1,000 Member Limit

10% of Share Price

Investor

Selection

Check

Email for

Status

Fund

2019

Purchase

Stock

Share in Success

Leave a Legacy

Share price locked in

Agree to Investor Pledge

Pay via PayPal / Credit

Weekly Selections

Selection notification via email

Wait Until $1 Million Goal Reached

Pay remaining 90%

Receive shares

Investor Information

VoteMatrix is now accepting applications to fund the development of the VoteMatrix App and share in the success of the company. We are asking individuals, not corporations, to invest in VoteMatrix and become one of our VoteMatrix Founding 1,000 members. VoteMatrix is building an unprecedented disruptive technology that will improve democracy throughout the world and your support is vital. Join with us in the most significant impact investment opportunity of a lifetime. This seed funding round offers up 38.46% of the company over 1,000 shares (max 10 per person).

Investor Info

Video

Closed Captions

Available

Investor Application Process

Applicants will provide a refundable deposit equal to 10% of the shares applied for, sign the Investor Pledge, and agree to provide full payment for their requested shares within 1 month of reaching $1 million in investor pledges. Shares will be issued upon receipt of payment. A queue of applicants will be maintained and each month, a limited number of investors will be selected. The price of each share will be fixed at the time of application. Once an application and deposit are received, the applicant will be provided an application number, including the fixed share price, and receipt of deposit. The price of shares may increase after each Investor Selection Date, but will not increase for the applicant unless they retract their application and reclaim their deposit. Investor share price is listed at the top of this page.

Investor Application Requirements

All applicants must sign the Investor Pledge and provide a 10% deposit prior to the selection date via PayPal or by check. An investor statement is recommended and should include any experience, goals, or thoughts regarding VoteMatrix and the Fix Democracy movement. You can also leave the question blank and email it to us later or post it via a social media account by tagging @VoteMatrix.

Investor Selection

On each selection date, applicants will be rated according to the following selection criteria. The top applicants will then be selected and notified of their membership in the Founding 1,000. They will also gain access to the Facebook private group at this time. Applicants not selected will remain in the pool until the next selection date and will not be affected by any increase in share price. Most applicants will be selected unless we have over 100 applicants in the queue. Applicants may also be rejected if they fail to adhere to the founding principles and investor pledge.

Selection Priority

(When too many investors apply within a single selection period)

-

Specific software development, media, political activism, philosophy, or startup experience

-

Participation in one or more VoteMatrix events (please note which events you have attended)

-

Political or social media presence or posts (bullying or violence will disqualify)

-

Investor statement (if provided)

-

Application date. Earliest to register has priority if all else is equal.

Stock Issuance, Refunds, and Full Payment Info

Upon reaching $1 million in funding, all selected investors in the Founding 1,000 will be notified to provide the additional 90% for their requested stocks (plus up to 3% in processing fees) within 2 weeks of notification. Additional applicants may be selected to replace any investors who cannot pay. Upon payment in full, each investor will be issued stock certificates signed by the president, Robert Freeman, and numbered based on the order of application selection. The stock purchase date can be postponed up until 1/1/2020 if VoteMatrix does not have $1 million in pledges. After 1/1/2020 if there are not $1 million in pledges, all deposits will be refunded.

Founding 1,000 Investor Perks

-

In-app user profile icon identifying you as a Founding 1,000 member

-

Invitation to the Founding 1,000 dinner party, hosted by VoteMatrix after release in 2020

-

Founding 1,000 investor Facebook group membership to discuss progress and direction

-

Access to all anonymous metrics available at no cost (personally identifiable user information will never be provided). These metrics may not be published or provided to another party to be published unless they are identified as open metrics.

-

You will own a high profile private stock with a very limited supply

-

This will result in an extremely high rate of appreciation

-

-

All shareholders will receive dividends through the distribution of at least 20% of profits each year VoteMatrix exceeds $10 Million in annual revenue

-

Funds for projected expenses may be withheld from profits for up to 3 years from revenue date

-

-

Additional perks may be provided as the company grows

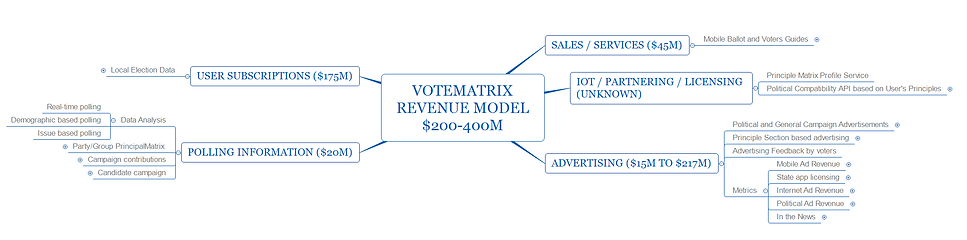

Revenue Model

The revenue model above represents the top five VoteMatrix revenue streams along with annual revenue estimates based on market research of similar social media and public service platforms with over 10 million users. This is only revenue projected from the VoteMatrix platform and does not include revenue from the consulting division, the manufacturing division (PhoneThrone production), or other revenue streams.

Market Advantages:

Targeted advertising revenue will be uniquely viable as we can ensure that advertised content will not offend users. Ads will target only users who agree with or are open to the products and brands based on their principles.

Campaigns and organizations can fund-raise in the most effective way possible. VoteMatrix will charge a small fee to collect donations directly through the targeted advertising model.

Polling provided will be near real-time and will be highly dimensional which is ideal for news agencies, campaigns, fundraisers, researchers, and marketers. This polling information will not include personally identifiable information in order to ensure the absolute privacy of our users with Private principles.

State and county agencies can license the mobile ballot app to reduce paper information guide expenses and provide a better experience for their districts.

Budget and Project Plan

This graph is taken from the development and budgeting plan for the first year of operation.

App modules will be developed in the following phases:

-

Architecture and Security

-

Principle Matrix - First 25

-

VoteMatrix Gov - Federal

-

VoteMatrix Ballot - Federal

-

VoteMatrix Gov - State

-

VoteMatrix Ballot - State

These efforts will run in parallel:

-

Marketing and Networking

-

Principle Matrix - Additional

-

Trusted Analysis - TrustMatrix

-

Operations

Investor Pledge - Application and Shareholder Requirements

-

Deposit

Applicant will provide a 10% deposit and sign the Investor Pledge, agreeing to all application requirements-

Deposit is mandatory to remain in the VoteMatrix Investor Queue as well as for those selected for the Founding 1,000 investor group

-

Deposit is fully refundable until selected. If selected, your deposit will be refundable for 1 month after the date you are notified of your selection. Contact fund@votematrix.com if you need to retract your application.

-

Deposit will be refunded if you are not chosen or do not qualify as an investor

-

Deposit will be refunded if we do not meet our goal of $1 million in funding by 1/1/2020

-

-

Payment Schedule

Applicant agrees to provide full payment for their requested shares by March 1st, 2019 or within 1 month of reaching $1 million in investor pledges, whichever comes later. This payment due date will also be the share authorization date. -

Share Cap

Maximum number of shares per individual: 10 shares-

Exceptions:

-

Employees and Advisory Board members may apply for and hold up to 40 shares each.

-

Type A shareholders may continue to hold up to their current percentage ownership in shares until such time as the VoteMatrix Shareholder Democratization provision goes into effect.

-

-

-

Shareholder Behavior

Shareholders and applicants must agree to uphold the Founding Principles listed in the About Us page. -

Personhood Requirement

Only individuals may apply for, purchase, or hold shares-

Corporations, other than VoteMatrix, Inc., may not apply for, purchase, or hold shares.

-

Trusts and other legal entities may not apply for, purchase, or hold shares unless each share is assigned to a beneficiary as an individual. The assigned individual would count as holding the share for all other purposes in this agreement.

-

Governments and their agencies may not apply for, purchase, or hold shares

-

-

VoteMatrix Shareholder Democratization

Shareholders with more than the maximum allowed shares agree to sell at least half of the excess shares per year. This requirement re-applies whenever new shares are received, such as through share splits. Asking price must be no more than twice the price of the previously sold share in the company plus 10% per month since the last share was sold or a $10,000 increase, whichever is greater. This provision will not begin (come into effect) until the year after VoteMatrix reaches 10 million verified registered voters. This provision shall be referred to as the VoteMatrix Shareholder Democratization provision. -

VoteMatrix Investor Queue

Shareholders agree to sell shares to buyers in the VoteMatrix Investor Queue unless there are no individuals in this queue. Any person qualified to hold a share whom also meets and agrees to the terms of this agreement may request a share via the VoteMatrix Investor Queue. Share sales through the VoteMatrix Investor Queue will go to the highest offer first. In case of a tie, the sale will go to the first to apply. Shares may also be listed for sale in the Votematrix Investor Queue at prices exceeding the current highest asking price but may not exceed the limits in provision 6 (VoteMatrix Shareholder Democratization). VoteMatrix may charge up to a 5% fee for each transaction completed through the VoteMatrix Investor Queue. -

Resell Limit (Broker Prevention)

Shares may not be resold within 1 year of issuance. -

Share Transfer Validity

Shares may not be sold to individuals who hold the maximum number of shares. Shares may not be sold to individuals who are in the process of purchasing shares from another shareholder. Shares may only be sold to individuals who also agree to and sign this agreement. -

Shareholder Non-Compliance and Revocation

Failure to adhere to these terms will result in the revocation of shares for the at fault shareholder upon approval by a 3/5 (three fifths) majority shareholder vote. This approval will be conducted by providing exactly one vote to each Type A and Type B shareholder, regardless of the quantity of shares held. 3/5 approval of participating shareholders is the requirement, no quorum is needed. Revoked shares will be sold via the VoteMatrix Investor Queue or bought back by VoteMatrix, Inc. at the current share price listed in the VoteMatrix Investor Queue. Funds from the sale will be paid to the shareholder whose share was revoked. Shareholders will be notified and a forum will be provided at least 7 days prior to the vote so that shareholders may discuss the infractions.

This shareholder vote will also include a question determining an exclusion period of 1 year, 5 years, 10 years, 25 years, or life. The exclusion period chosen by this vote will determine how long the at fault shareholder will be restricted from owning shares in VoteMatrix. -

Right of First Refusal

Prior to any stock transfer taking place, VoteMatrix reserves the right of first refusal unless the transaction is processed through the VoteMatrix Investor Queue. -

Shareholder Registration and Transparency

All share transfers must be registered and tracked by VoteMatrix. VoteMatrix will process share transactions within 1 week of submittal. VoteMatrix reserves the right to delegate share sale transaction processing to the buying or selling parties in lieu of charging a transaction fee if VoteMatrix is unable to process the transaction internally. In this case, the transaction fee will be 1% or less. Shareholders agree to have their legal name, city of residence, a bio, and investor statement published publicly on the VoteMatrix website. Shareholders can request retraction of any of these items except for last name and city, but the final decision remains with VoteMatrix. -

Share Issuance and Value

Founding 1,000 (Type B) shares will be equity ownership in VoteMatrix. On the share authorization date, 1,600 Type A shares will be issued to current owners followed by Type B shares issued to Founding 1,000 applicants who have paid in full. 1,000 Type B shares will be authorized and the VoteMatrix treasury will retain any unissued Type B shares for future sale.-

Notes:

-

In this way, investors will own a small percentage of a well funded company without much outlay of capital

-

Investors who pledge at a lower price (earlier) will receive the same shares as investors who pledge shares at a higher price (later)

-

Each share will be worth .03846% ownership at time of authorization

-

-

-

Low Income Reserved Shares

200 shares in the Founding 1,000 will be reserved for applicants who apply for a single share. This provision is meant to avoid an ownership bias towards wealthy investors and only applies if at least 30% of the applicants have applied for exactly one share. Investors agree that they have sufficient savings to afford this investment without it being detrimental to thier wellbeing. Investors may not apply for shares beyond their ability to afford as defined in the JOBS Act as follows:-

The aggregate amount sold to any investor during the 12-month period preceding the date of such transaction, does not exceed the greater of $2,000 or 5 percent of the annual income or net worth of such investor, as applicable, if either the annual income or the net worth of the investor is less than $100,000; and 10 percent of the annual income or net worth of such investor, as applicable, not to exceed a maximum aggregate amount sold of $100,000, if either the annual income or net worth of the investor is equal to or more than $100,000

-

-

Corporate Info

VoteMatrix incorporated in the state of California in 2011 under the name "VoteMatrix, Inc." and is listed under California secretary of State entity number: C3359926. All references to VoteMatrix in this agreement refer to this company. VoteMatrix will be registered as a California Public Benefit Corporation prior to issuing shares. This will ensure our primary purpose is always to provide accurate political information and to empower voters, analysts, and activists through technology with free access to the public. Profit will be a secondary purpose. -

Severance Clause

Any provision of this agreement deemed illegal or non-binding according to the legal authority with jurisdiction over the provision will only void the section deemed illegal or non-binding. All other provisions will remain in effect. Any provision voided in this way and related provisions may be reworded by the presiding authority to retain the intent of the provision and still remain in effect. -

Voting Rights

Voting rights for Type B shareholders and establishment of a Board of Directors will occur the year after VoteMatrix reaches 10 million verified registered voters. Until then, Type B shares will only have voting rights in the cases of revoked shares and share transfers over 15% of the equity of VoteMatrix. Voting rights after reaching 10 million verified registered voters will equal 1 vote per shareholder, regardless of the number of shares held. -

Dividend Equality

Dividends will be distributed equally amongst Type A and Type B shareholders with no preference given to either type. -

Share Dilution Equality

Share dilution will occur equally for Type A and Type B shares. Dilution occurs when additional shares are authorized. -

Foreign Ownership Limitation

Shares must be exclusively issued to citizens of the United States of America if 20% or more non-US citizens ("Foreign Investors") hold shares. When this restriction is in effect, the VoteMatrix Investor Queue shall provide a separate queue for Foreign Investors that only issues shares to Foreign Investors from existing Foreign Investor shareholders. Citizens and Foreign investors will be considered equally for shares posted in the Foreign investor queue.

All shareholders applying for or holding shares in VoteMatrix, Inc. are bound by these provisions.